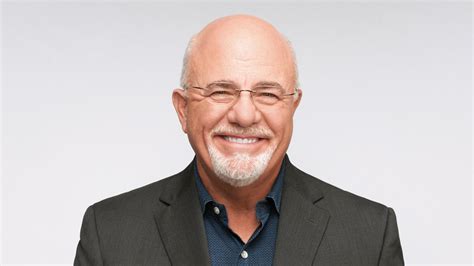

A San Jose man’s unconventional approach to wealth accumulation, relying heavily on cryptocurrency investments, has surprised financial guru Dave Ramsey, known for his staunch advocacy of debt reduction and traditional investment strategies. The man, identified as only “Michael,” revealed on Ramsey’s show that he amassed a million-dollar portfolio primarily through cryptocurrency, a strategy sharply contrasting Ramsey’s financial advice.

Michael called into “The Ramsey Show” seeking guidance on managing his newfound wealth, which he largely attributed to early investments in cryptocurrency. According to Yahoo Finance, Ramsey was visibly taken aback by Michael’s revelation, as his own financial philosophy typically steers clear of volatile investments like cryptocurrency, favoring instead a more conservative approach centered on mutual funds, real estate, and eliminating debt.

The exchange highlighted a growing divide between traditional financial wisdom and the emerging strategies embraced by a new generation of investors who are willing to take on higher risks in pursuit of potentially higher returns. While Ramsey acknowledged Michael’s success, he remained firm in his belief that cryptocurrency is a risky investment and not a sustainable path to long-term financial security.

The conversation has ignited a debate among financial experts and everyday investors alike, questioning the relevance of traditional financial advice in a rapidly evolving investment landscape. Many are now contemplating whether a balanced portfolio should include at least some allocation to digital assets, while others remain skeptical, siding with Ramsey’s cautious approach.

Michael, a self-described diligent investor, explained that he had carefully researched various cryptocurrencies before investing, focusing on projects with strong fundamentals and long-term potential. He also emphasized the importance of diversification within the cryptocurrency market itself, rather than putting all his eggs in one basket.

Ramsey’s initial reaction was one of disbelief, as he repeatedly questioned Michael about the authenticity of his claims and the potential risks involved. He argued that cryptocurrency is inherently speculative and that its value is based on hype and speculation rather than any intrinsic worth.

Despite Ramsey’s reservations, Michael maintained that he had made informed decisions based on his own research and risk tolerance. He also pointed out that cryptocurrency has the potential to generate significant returns, especially for those who invest early in promising projects.

The incident underscores a broader generational shift in attitudes toward investing, with younger investors increasingly willing to embrace alternative assets and challenge traditional financial norms. This shift presents both opportunities and challenges for financial advisors, who must adapt their strategies to meet the evolving needs and preferences of their clients.

Digging Deeper: The Conversation and Its Implications

The specific details of the conversation between Michael and Dave Ramsey are crucial to understanding the significance of this exchange. Michael’s call into “The Ramsey Show” wasn’t just about bragging about his crypto gains; it was a genuine attempt to seek advice on how to manage his newfound wealth responsibly. He wanted to know how to diversify his portfolio, minimize his tax liabilities, and ensure long-term financial security.

Ramsey, while acknowledging Michael’s success, couldn’t reconcile it with his own financial principles. He repeatedly warned Michael about the potential for cryptocurrency to crash and wipe out his entire investment. He also questioned the ethical implications of investing in a market that he believes is rife with scams and manipulation.

“I’m not saying you’re doing anything wrong,” Ramsey told Michael, “but I am saying that cryptocurrency is a very risky investment. It’s not something that I would ever recommend to anyone.”

Ramsey’s skepticism stems from his deep-seated belief in the importance of debt reduction and long-term investing. He advocates for paying off all debt, including mortgages, and investing in low-cost mutual funds that track the overall market. He believes that this approach, while not as exciting as investing in cryptocurrency, is the safest and most reliable way to build wealth over time.

Michael, on the other hand, argued that Ramsey’s approach is too conservative for younger investors who have more time to take on risk. He pointed out that traditional investments, such as stocks and bonds, have historically generated lower returns than cryptocurrency, especially over the past decade.

“I understand your concerns about risk,” Michael told Ramsey, “but I also believe that the potential rewards of cryptocurrency outweigh the risks. I’m not saying that everyone should invest in crypto, but I think it’s important for people to at least consider it as part of a diversified portfolio.”

The conversation between Michael and Dave Ramsey highlights a fundamental difference in perspective on risk and reward. Ramsey is primarily concerned with protecting his listeners from losing money, while Michael is more focused on maximizing his potential returns.

The Generational Divide in Investing

The exchange between Michael and Dave Ramsey also reflects a broader generational divide in attitudes toward investing. Younger investors, who have grown up in a digital age, are more comfortable with technology and more willing to experiment with new investment strategies. They are also more likely to be skeptical of traditional financial institutions and advisors.

According to a recent survey by Charles Schwab, millennials are twice as likely as baby boomers to invest in cryptocurrency. They are also more likely to use online platforms and mobile apps to manage their investments.

This generational shift presents both opportunities and challenges for the financial industry. Financial advisors need to adapt their strategies to meet the evolving needs and preferences of younger investors. They also need to educate them about the risks and rewards of different investment options.

One of the biggest challenges is bridging the gap between traditional financial wisdom and the emerging strategies embraced by younger investors. Many financial advisors are hesitant to recommend cryptocurrency to their clients, citing concerns about risk and volatility. However, ignoring cryptocurrency altogether could alienate a significant portion of the younger generation.

A more balanced approach is to acknowledge the potential benefits of cryptocurrency while also emphasizing the importance of risk management and diversification. Financial advisors can help their clients understand the risks involved in cryptocurrency investing and develop a strategy that aligns with their individual goals and risk tolerance.

The Role of Cryptocurrency in a Diversified Portfolio

The question of whether cryptocurrency should be included in a diversified portfolio is a subject of ongoing debate among financial experts. There is no consensus on this issue, and opinions vary widely.

Some experts argue that cryptocurrency is too risky and speculative to be included in a diversified portfolio. They point to the extreme volatility of cryptocurrency prices and the potential for scams and manipulation. They also argue that cryptocurrency has no intrinsic value and that its price is based solely on speculation.

Other experts argue that cryptocurrency has the potential to generate significant returns and that it can serve as a hedge against inflation. They also point to the growing adoption of cryptocurrency by institutional investors and the increasing development of blockchain technology.

Ultimately, the decision of whether to include cryptocurrency in a diversified portfolio is a personal one that should be based on individual circumstances and risk tolerance. There is no one-size-fits-all answer to this question.

If you are considering investing in cryptocurrency, it is important to do your research and understand the risks involved. You should also consult with a qualified financial advisor to develop a strategy that aligns with your individual goals and risk tolerance.

Key Considerations Before Investing in Cryptocurrency

Before investing in cryptocurrency, it is crucial to consider several key factors to make informed decisions and manage risk effectively:

-

Risk Tolerance: Cryptocurrency investments are highly volatile and can experience significant price swings. Assess your personal risk tolerance and ensure you are comfortable with the possibility of losing a substantial portion of your investment.

-

Investment Goals: Define your investment goals and determine if cryptocurrency aligns with your long-term financial objectives. Consider whether you are seeking short-term gains or long-term growth.

-

Research: Conduct thorough research on the specific cryptocurrencies you are considering investing in. Understand their underlying technology, use cases, and market potential.

-

Diversification: Do not put all your eggs in one basket. Diversify your cryptocurrency investments across different projects to mitigate risk. Also, ensure your overall portfolio includes other asset classes, such as stocks, bonds, and real estate.

-

Security: Secure your cryptocurrency holdings by using reputable exchanges and wallets. Enable two-factor authentication and store your private keys offline in a cold storage wallet.

-

Tax Implications: Understand the tax implications of cryptocurrency investments in your jurisdiction. Consult with a tax professional to ensure you are compliant with all applicable laws.

-

Regulatory Environment: Stay informed about the regulatory environment surrounding cryptocurrency in your region. Regulations can change rapidly and impact the value and legality of certain cryptocurrencies.

-

Scams and Fraud: Be wary of scams and fraudulent schemes in the cryptocurrency market. Do not invest in projects that promise unrealistic returns or lack transparency.

-

Due Diligence: Conduct thorough due diligence on any cryptocurrency project before investing. Evaluate the team, technology, and market potential of the project.

-

Long-Term Perspective: Adopt a long-term perspective when investing in cryptocurrency. Avoid making impulsive decisions based on short-term market fluctuations.

The Future of Financial Advice

The conversation between Michael and Dave Ramsey has significant implications for the future of financial advice. As younger investors increasingly embrace alternative assets and challenge traditional financial norms, financial advisors must adapt their strategies to meet the evolving needs and preferences of their clients.

This adaptation requires financial advisors to become more knowledgeable about cryptocurrency and other alternative assets. They also need to be more willing to engage in open and honest conversations with their clients about the risks and rewards of different investment options.

Furthermore, financial advisors need to embrace technology and use online platforms and mobile apps to better serve their clients. They also need to be more transparent about their fees and provide personalized advice that is tailored to each client’s individual circumstances.

The future of financial advice is likely to be more personalized, technology-driven, and focused on helping clients achieve their individual financial goals. Financial advisors who are willing to adapt to these changes will be well-positioned to succeed in the years to come. Those who remain stuck in the past risk becoming irrelevant.

Expert Opinions and Counterarguments

While Dave Ramsey holds a strong stance against cryptocurrency, other financial experts have different perspectives on its role in investment portfolios. Some argue that a small allocation to cryptocurrency can enhance portfolio returns and provide diversification benefits.

Cathie Wood, the CEO of Ark Invest, is a prominent advocate for cryptocurrency. She believes that Bitcoin has the potential to reach $1 million per coin in the long term and that it can serve as a hedge against inflation.

“Bitcoin is the first truly global, decentralized, digital currency,” Wood said in a recent interview. “It has the potential to disrupt the traditional financial system and create a more inclusive and efficient economy.”

Other experts, such as Anthony Pompliano, a cryptocurrency investor and commentator, also believe that Bitcoin has a bright future. He argues that Bitcoin is a scarce asset that is resistant to censorship and inflation.

“Bitcoin is the hardest asset in the world,” Pompliano said. “It is the only asset that is truly decentralized and cannot be controlled by any government or corporation.”

However, even experts who are bullish on cryptocurrency acknowledge the risks involved. They emphasize the importance of doing your research, diversifying your portfolio, and only investing what you can afford to lose.

The Psychology of Investing in Cryptocurrency

Investing in cryptocurrency can be an emotional roller coaster. The extreme volatility of cryptocurrency prices can trigger feelings of fear, greed, and anxiety. It is important to be aware of these emotions and to avoid making impulsive decisions based on them.

One common mistake that investors make is chasing gains. When they see the price of a cryptocurrency rising rapidly, they may be tempted to buy in without doing their research. This can lead to them buying at the top of the market and losing money when the price crashes.

Another common mistake is selling out of fear. When they see the price of a cryptocurrency falling rapidly, they may be tempted to sell to cut their losses. This can lead to them missing out on potential gains when the price rebounds.

To avoid these mistakes, it is important to have a well-defined investment strategy and to stick to it. You should also avoid checking the price of your cryptocurrency investments too frequently. This can lead to unnecessary stress and anxiety.

Case Studies of Successful Cryptocurrency Investors

While many people have lost money investing in cryptocurrency, there are also numerous examples of people who have made significant gains. These success stories can provide inspiration and guidance for those who are considering investing in cryptocurrency.

One famous example is Erik Finman, who invested $1,000 in Bitcoin in 2011 when he was just 12 years old. By 2017, his Bitcoin holdings were worth over $4 million. He used his profits to start his own company and to travel the world.

Another example is Jeremy Gardner, who invested in Bitcoin in 2013 and used his profits to start a venture capital firm that invests in cryptocurrency startups. He has become a prominent figure in the cryptocurrency community and is known for his insightful analysis and predictions.

These case studies demonstrate that it is possible to make significant gains by investing in cryptocurrency. However, it is important to remember that these are exceptional cases and that the vast majority of investors do not achieve such extraordinary results.

Frequently Asked Questions (FAQ)

-

What was Dave Ramsey’s reaction to the San Jose man’s crypto success? Dave Ramsey was surprised and visibly skeptical. He cautioned against the inherent risks of cryptocurrency investments, emphasizing his preference for more traditional, conservative investment strategies like mutual funds and real estate. He questioned the sustainability of Michael’s approach.

-

Why is Dave Ramsey so against cryptocurrency? Ramsey’s financial philosophy centers on eliminating debt and investing in stable, long-term assets. He views cryptocurrency as a speculative and volatile asset class, lacking intrinsic value and prone to scams and manipulation, making it unsuitable for his followers who prioritize financial security and risk aversion.

-

What was the San Jose man’s strategy for investing in cryptocurrency? The San Jose man, “Michael,” emphasized careful research and diversification within the cryptocurrency market. He focused on projects with strong fundamentals and long-term potential, rather than blindly investing in hype-driven assets.

-

What does this incident reveal about the generational gap in investing? This incident highlights a growing generational divide in investment approaches. Younger investors are more open to alternative assets like cryptocurrency, driven by technological familiarity and a desire for higher returns, while older generations often prefer traditional, lower-risk investments.

-

What are the key risks to consider before investing in cryptocurrency? Key risks include extreme price volatility, the potential for scams and fraud, regulatory uncertainty, and the lack of intrinsic value in many cryptocurrencies. It’s crucial to conduct thorough research, diversify investments, and only invest what you can afford to lose.

Expanded Analysis of Dave Ramsey’s Perspective:

Dave Ramsey’s staunch opposition to cryptocurrency is deeply rooted in his overall financial philosophy, which prioritizes debt elimination, conservative investments, and long-term financial security. His approach, often referred to as the “Ramsey Baby Steps,” is designed to help individuals and families gain control of their finances by systematically tackling debt and building wealth through disciplined saving and investing.

-

Debt Aversion: Ramsey is an ardent advocate for living debt-free, including mortgages. He believes that debt is a major obstacle to financial freedom and that individuals should strive to eliminate it as quickly as possible. Cryptocurrency, often requiring initial capital and potentially involving leverage, can easily lead to increased debt if not managed carefully, directly contradicting his core principle.

-

Conservative Investments: Ramsey recommends investing in low-cost mutual funds that track the overall market, emphasizing diversification and long-term growth. He favors investments that have a proven track record and are less susceptible to extreme volatility. Cryptocurrency, known for its dramatic price swings, clashes with his preference for stable, predictable returns.

-

Financial Education: Ramsey’s primary mission is to educate people about personal finance and empower them to make informed decisions. He believes that many people lack the knowledge and skills necessary to navigate the complexities of the financial world and that they are often misled by salespeople and marketing hype. He sees cryptocurrency as an area where many investors lack understanding and are therefore vulnerable to scams and losses.

-

Risk Management: Ramsey is highly risk-averse and encourages his followers to prioritize financial security over potential gains. He believes that it is better to err on the side of caution and to avoid investments that are too risky. Cryptocurrency, with its potential for both massive gains and significant losses, is seen as an inherently risky investment that is not suitable for most people.

-

Focus on Fundamentals: Ramsey emphasizes the importance of investing in companies with strong fundamentals and a proven track record of profitability. He believes that investors should focus on the underlying value of an asset rather than relying on speculation or hype. Cryptocurrency, often lacking tangible assets or established business models, is seen as being driven primarily by speculation.

Ramsey’s perspective is particularly relevant for individuals who are new to investing or who are struggling with debt. His approach provides a clear and straightforward path to financial stability, but it may not be suitable for everyone. More experienced investors with a higher risk tolerance may choose to allocate a portion of their portfolio to alternative assets like cryptocurrency.

The Argument for Cryptocurrency in a Modern Portfolio:

While Dave Ramsey’s concerns about the risks of cryptocurrency are valid, there are also compelling arguments for including it in a modern investment portfolio, especially for those with a longer time horizon and a higher risk tolerance.

-

Potential for High Returns: Cryptocurrency has the potential to generate significant returns, particularly in the early stages of adoption. While past performance is not indicative of future results, many cryptocurrencies have significantly outperformed traditional assets like stocks and bonds over the past decade.

-

Diversification Benefits: Cryptocurrency can provide diversification benefits to a portfolio by having a low correlation with traditional asset classes. This means that when stocks and bonds are declining in value, cryptocurrency may hold its value or even increase, helping to cushion the overall portfolio from losses.

-

Hedge Against Inflation: Some cryptocurrencies, like Bitcoin, are designed to be scarce, with a limited supply. This makes them potentially resistant to inflation, as their value is not easily eroded by increases in the money supply. In a world where governments are increasingly printing money, cryptocurrency may serve as a store of value that can protect against inflation.

-

Technological Innovation: Cryptocurrency is based on blockchain technology, which has the potential to disrupt a wide range of industries, from finance to healthcare to supply chain management. Investing in cryptocurrency is a way to gain exposure to this emerging technology and to participate in its potential growth.

-

Decentralization: Cryptocurrency is decentralized, meaning that it is not controlled by any single entity, such as a government or a corporation. This makes it potentially resistant to censorship and manipulation. In a world where governments are increasingly exerting control over information and financial flows, cryptocurrency may offer a way to protect individual freedom and autonomy.

-

Accessibility: Cryptocurrency is accessible to anyone with an internet connection, regardless of their location or financial status. This makes it a potentially democratizing force that can empower individuals and communities around the world.

It’s crucial to acknowledge that investing in cryptocurrency involves significant risks, including the potential for loss of capital, regulatory uncertainty, and cybersecurity threats. However, for those who are willing to do their research, manage their risk, and take a long-term perspective, cryptocurrency can be a valuable addition to a diversified investment portfolio.

Strategies for Managing Risk in Cryptocurrency Investments:

Even if you believe in the potential of cryptocurrency, it’s essential to manage your risk effectively to protect your capital and avoid making costly mistakes. Here are some strategies for managing risk in cryptocurrency investments:

-

Do Your Research: Before investing in any cryptocurrency, it’s crucial to do your research and understand the underlying technology, the team behind the project, and the market potential. Don’t rely on hype or speculation; instead, focus on the fundamentals.

-

Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your cryptocurrency investments across different projects, and also diversify your overall portfolio across different asset classes, such as stocks, bonds, and real estate.

-

Only Invest What You Can Afford to Lose: Cryptocurrency is a high-risk investment, and you should only invest what you can afford to lose without impacting your financial well-being. Don’t borrow money to invest in cryptocurrency, and don’t use money that you need for essential expenses.

-

Use Stop-Loss Orders: Stop-loss orders can help to limit your losses by automatically selling your cryptocurrency if the price falls below a certain level. This can prevent you from holding onto a losing investment for too long.

-

Store Your Cryptocurrency Securely: Use a reputable exchange or wallet to store your cryptocurrency, and enable two-factor authentication for added security. Consider using a cold storage wallet, which is a physical device that stores your cryptocurrency offline, to protect it from hackers.

-

Be Wary of Scams: The cryptocurrency market is rife with scams and fraudulent schemes. Be wary of projects that promise unrealistic returns or that lack transparency. Do your due diligence before investing in any project, and never give out your private keys or other sensitive information.

-

Stay Informed: The cryptocurrency market is constantly evolving, and it’s important to stay informed about the latest news and developments. Follow reputable news sources, attend industry events, and engage with the cryptocurrency community to stay up-to-date.

-

Take a Long-Term Perspective: Cryptocurrency is a long-term investment, and you should be prepared to hold onto your investments for several years to realize their full potential. Don’t get caught up in short-term market fluctuations, and don’t make impulsive decisions based on fear or greed.

The Broader Impact on Financial Planning:

The discussion surrounding cryptocurrency and its place in investment strategies has broader implications for the field of financial planning. Financial advisors need to adapt to the evolving landscape and provide guidance that reflects the realities of the modern investment world. This includes:

-

Understanding Cryptocurrency: Advisors need to educate themselves about cryptocurrency, its underlying technology, and the associated risks and opportunities. This knowledge is essential for having informed conversations with clients and providing relevant advice.

-

Assessing Risk Tolerance: Advisors need to accurately assess their clients’ risk tolerance and investment goals. Cryptocurrency may be suitable for some clients but not for others, depending on their individual circumstances.

-

Developing Personalized Strategies: Advisors need to develop personalized investment strategies that take into account their clients’ specific needs and preferences. This may involve incorporating a small allocation to cryptocurrency for some clients while excluding it entirely for others.

-

Providing Education and Guidance: Advisors need to educate their clients about the risks and rewards of different investment options, including cryptocurrency. They should also provide guidance on how to manage risk effectively and avoid making costly mistakes.

-

Staying Updated: The financial landscape is constantly changing, and advisors need to stay updated on the latest trends and developments. This includes monitoring the cryptocurrency market, attending industry events, and engaging with the financial community.

By adapting to the changing landscape and providing personalized guidance, financial advisors can help their clients navigate the complexities of the modern investment world and achieve their financial goals. The conversation between Michael and Dave Ramsey serves as a reminder that there is no one-size-fits-all approach to financial planning and that advisors must be prepared to tailor their advice to meet the unique needs of each individual client.